Our Expertise

As technology and digital capabilities are becoming the cornerstone of companies’ performance and value creation opportunities, strategic recommendations on investment opportunities must increasingly be based on an in-depth understanding of operational skills, maturity, and associated digital/tech KPIs.

Our practice is based on such principles, and we operate uniquely via a differentiated ICT and finance experts, which bring to the table unparalleled expertise in Public and Private Cloud, Consultancy, Software Development, Data Science, Cyber , and Business Application.

We are experts in sourcing and screening acquisition targets within the dynamic landscape of midsize ICT companies, with valuations ranging from €5m to €100m.

Our portfolio covers businesses across following verticals and beyond:

Business Intelligence, Data & AI

Data strategy, Data&AI

Data integration / data management

Data visualization

Business Intelligence

Power BI, Power Platform, Qlik, Talend,

TimeXtender...

Public/Private Cloud, Managed Services & Cybersecurity

Data-Center infrastructure

Modern Workplace

Managed Services, Cybersecurity,

Data management, back-up and storage

Managed hosting

Azure, AWS, Google, MS365, Kubernetes, ...

Business Applications (ERP, CRM)

Implementation consultancy

Maintenance & customer service

Software-as-a-Service

ERP & CRM

Dynamics 365, SAP, Oracle...

Cloud Consultancy & Professional Services

Cloud consultancy

Data platform consultancy

Business Continuity support

Business Applications

Azure, AWS, MS365, Power Platform,

.NET / Storyblok / React Native…

Software development, DevOps & UX Design

App development (front-end / UX / back-end)

Software Development

DevOps, Design…

Market focus

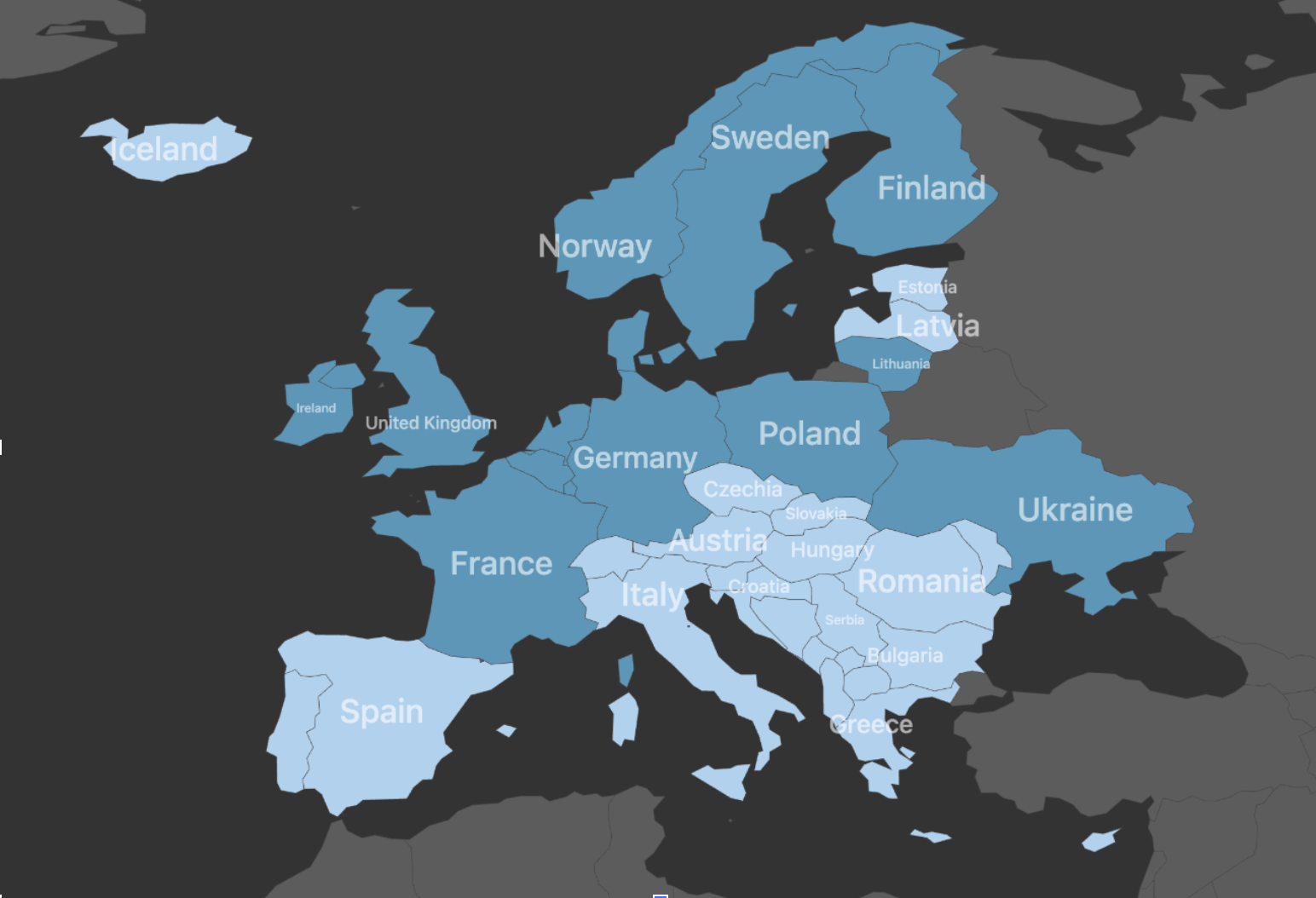

Our markets reach spans primarily across Europe with an active presence in Northern Europe, with key associates based in the UK, Netherlands, France as well as Singapore.

European Focus

Existing Engagements

Our M&A Advisors Network

M&A Advisors serve as a finely tuned barometer for the state of the M&A market. The M&A network specialised in our industry is extensive with hundreds of Advisors across Europe.

Depending on the countries, the M&A culture and openness to discussing the topic vary significantly by country. For example, in the UK it is much easier to engage directly with CEOs comparing in Germany.

In Germany CEOs are more inclined to speak with M&A experts who have a strong reputation, due to the local culture and close professional networks.

Being well-known within the M&A network can help in identifying new opportunities early in the process and gaining better attention from companies that are for sale.

Currently Fox Business Consulting is well connected with M&A advisor communities in the UK, German and France.